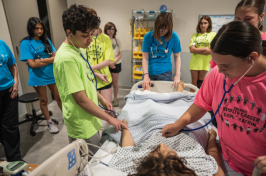

The University of New Hampshire inspires innovation and transforms lives in our state, nation and world. More than 16,000 students from all 50 states and 71 countries engage with an award-winning faculty in top-ranked programs in business, engineering, law, health and human services, liberal arts and the sciences across more than 200 programs of study. A Carnegie Classification R1 institution, UNH partners with NASA, NOAA, NSF and NIH, and received $260 million in competitive external funding in FY21 to further explore and define the frontiers of land, sea and space.

UNH Expert Available to Discuss How to Ride Out Turbulent Stock Market

DURHAM, N.H.— The tumbling financial market has some Americans on edge, adding to the already stressful situation surrounding the coronavirus, health concerns, business closings, and social distancing. Stephen Ciccone, associate professor of finance at the University of New Hampshire, can comment on what this could mean for portfolios and 401K’s and why it’s important for people to remain calm.

“I am a big proponent of buy-and-hold strategies,” says Ciccone. “While stocks are down right now, when the market starts to recover, it can increase very rapidly in a short period of time. Even though many may want to pull their money out, individual investors fleeing stocks now could potentially miss out on high recovery returns later.”

Ciccone, whose research has looked at investing during major depressions, recessions and crashes, says history shows that over extended periods of time, the stock market is consistently up and until recent events around the coronavirus, it’s been considered a bull market since the 2008 financial crisis. He said young investors should be able to weather the current market fluctuations. Those closer to retirement should be more invested in lower risk securities, such as bonds, so their losses would not be as dramatic. But overall, he recommends a dollar cost averaging investing strategy.

“The coronavirus presents a unique situation with much uncertainty,” says Ciccone. “I expect a lot of volatility over the next few weeks, or even months, as new information is processed by markets. The best strategy during volatile times is to invest the same amount at regular intervals. For example, $500 every month. I do expect that stocks will recover in a significant way within the next couple years.”

Ciccone can be reached at 727-267-9153 or stephen.ciccone@unh.edu.

Ciccone is the chair of the department of accounting and finance and an associate professor of finance at UNH’s Peter T. Paul College of Business and Economics. He is also a certified public accountant and among his research interests are stock return properties, analyst forecasts, and behavioral finance.

Latest News

-

September 15, 2025

-

August 21, 2025

-

August 12, 2025

-

August 5, 2025

-

June 25, 2025