The University of New Hampshire inspires innovation and transforms lives in our state, nation and world. More than 16,000 students from all 50 states and 71 countries engage with an award-winning faculty in top-ranked programs in business, engineering, law, health and human services, liberal arts and the sciences across more than 200 programs of study. A Carnegie Classification R1 institution, UNH partners with NASA, NOAA, NSF and NIH, and received $260 million in competitive external funding in FY21 to further explore and define the frontiers of land, sea and space.

UNH Finds Franchising Sector Weathers 2018 Headwinds

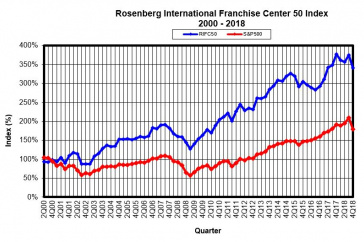

Graph of the Rosenberg International Franchise Center 50 Index, 2000 - 2018

DURHAM, N.H.—The franchising sector, like most sectors of the U.S. economy, faced strong headwinds in the last quarter of 2018, causing the University of New Hampshire’s franchising sector-focused RIFC 50 Index™ to lose 9.5% of its market value in 2018 overall vs a 6.2% drop in the S&P 500 Index for the year. Developed and published by UNH’s Rosenberg International Franchise Center (RIFC), it is the first stock index to track the financial market performance of the U.S. franchising sector.

The macro environment in the U.S. and overseas deteriorated significantly in the last quarter of 2018 as fears of a trade war between the U.S. and China increased, the Federal Reserve signaled a more restrictive monetary policy implying higher interest rates, an economic recession became a near-term possibility, and political gridlock took hold in Washington. As a result, most financial markets dropped sharply in the 4th quarter of 2018.

“In Q4, the S&P 500 Index dropped 14%, and the Nasdaq Composite lost 17.5% of its value, whereas the RIFC 50 Index only dropped 8.9%,” said E. Hachemi Aliouche, director of the Rosenberg International Franchise Center at UNH’s Peter T. Paul College of Business and Economics, and developer of the RIFC 50 stock index.

Though 2018 proved to be challenging for most companies (35 out of the 50 RIFC components suffered market declines, many double-digit), several RIFC 50 Index components managed to avoid losses, and some, in fact, thrived.

“Restaurant operator and franchisor Wingstop (WINGS) added over 80% to its market value in 2018, while fitness centers operator and franchisor Planet Fitness’ (PLNT) market value jumped by over 50%,” said Aliouche.

RIFC 50 Index components continued to be snapped up by other companies in 2018, signaling continued recognition of the value of franchise businesses. Hotel operator and franchisor La Quinta was acquired by hotel franchisor Wyndham Hotels & Resorts, while Jamba Juice was bought by Focus Brands, and Sonic was acquired by Inspire Brands, the owner of the Arby’s and Buffalo Wild Wings brands.

Since its inception in 2000, the RICF 50 Index is up 241.5% while the S&P 500 Index is up 79.8% over the same period.

“Our RIFC 50 Index quarterly reports offer a succinct look at the best and worst performers from among the 50 franchise businesses in the portfolio, and the business reasons that may have contributed to their rise or fall in the quarterly ranking,” said Aliouche. The 2018 quarterly reports are available on the center’s website at unh.edu/rosenbergcenter/rcf-50-index.

To learn more about RIFC, visit unh.edu/rosenbergcenter and follow @RIFC_UNH on Twitter.

IMAGES FOR DOWNLOAD:

https://www.unh.edu/unhtoday/sites/default/files/media/rifc50index_2018yearendreptable.jpg

Caption: Table Comparing RIFC 50 Index and S&P 500 Index™ Total Returns, 2000-2018

https://www.unh.edu/unhtoday/sites/default/files/media/rifc50index_2018yearendrepgraph.jpg

Caption: Graph of the Rosenberg International Franchise Center 50 Index 2000 - 2018

Latest News

-

December 4, 2025

-

November 26, 2025

-

November 6, 2025

-

November 5, 2025

-

October 24, 2025