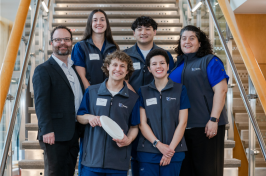

Aidan Kittredge '21, Rines Angel Fund member

The Rines Angel Fund was a natural fit for Aidan Kittredge ’21. At the age of 12, the Hampton, N.H., native had started a nonprofit organization called Dress for School Success to provide free, gently worn clothes to school-aged children. It had expanded to two locations in Hampton and Seabrook by the time Kittredge graduated from Winnacunnet High School. As a UNH freshman and economics major, she had learned about the Rines Angel Fund through Paul College’s First-Year Innovation and Research Experience program, and it spoke to her passion for creating innovative opportunities for others.

“In part because of my own experience with Dress for School Success, the idea of playing a role in helping promising business ideas get off the ground and become a reality appealed to me,” she says.

Like venture capitalists, angel investors provide “seed funds” for start-up businesses, though using their own money rather than a corporate pool of funds. UNH’s Rines Angel Fund was established in 2015 through the generosity of longtime UNH supporter S. Melvin Rines ’47, who donated nearly $200,000 to start the fund. The first undergraduate student-managed angel fund on the East Coast and one of the first in the country, the Rines Angel Fund gives student investors hands-on experience in private equity markets and entrepreneurial finance. Through a yearlong, four-credit course, Rines Angel Fund students work closely with Jeffrey Sohl, director for UNH’s Center for Venture Research, to evaluate pitches from fledgling companies, conduct extensive due diligence, and select one or two groups to receive between $5,000 and $15,000 of funding. Enrollment in the class is competitive and requires a rigorous application process.

Kittredge currently serves the Rines Angel Fund executive team as one of two managing directors, helping to plan curriculum, source deals and develop an upcoming webinar on diversity in private equity. As she embarks on her fourth semester with the fund, she sees the experience as one of the most meaningful aspects of her time at UNH. “I absolutely love it,” she says. “It’s given me invaluable experience to research groundbreaking technology, network with entrepreneurs and investors alike, and practice the skills I will need to excel in my career.”

The experience has also included avenues to internships for Kittredge. In 2019, she worked for Manchester-based Minim, a home-internet startup. This summer, COVID-19 notwithstanding, she completed an internship with Salem-based cosmetics startup Aisling Organics, growing the company’s social media presence and planning photo shoots — an experience that may well lead her to a future in advertising.

The benefits Kittredge describes are among those Rines hoped students would reap when he first sat down with Sohl and others to develop the fund. A longtime UNH Foundation Board member and previous supporter of the Paul College building, the university’s high-tech business classrooms, international service projects for students and more, Rines says providing students with real-world investment experience that at the same time could benefit others beyond the university appealed to him.

“Jeff and I both had very specific ideas and a strong vision for how the fund would work and what students would get from the experience when we first developed it,” says Rines, a former Kidder Peabody investment banker. “I’ve been very impressed with the students who have worked with the fund over the past five years and how seriously they’ve taken the opportunity.”

-

Written By:

Kristin Waterfield Duisberg | Communications and Public Affairs